Recurring revenue is the center of the subscription business universe – not just for your personal accounts on Netflix, Spotify, and Amazon but also for any software-as-a-service (SaaS). And the key metric that any subscription-based business keeps a keen eye on is monthly recurring revenue (MRR).

Monthly recurring revenue, or MRR, is the predictable income a business earns each month from active subscriptions or ongoing services. In simpler terms, it’s the steady stream of cash you can count on from your loyal subscriber base.

Calculating MRR lets you see the business’s financial health, analyze growth, combat churn, and produce more revenue. Companies use subscription management tools to track everything related to subscriptions and billing, and MRR is a critical metric that’s measured using these tools.

What is the MRR formula?

There isn’t a single, universal MRR formula because it depends on your specific subscription model

However, a common approach is adding together all active and non-renewing subscriptions, excluding those in free trials or averaging your recurring revenue per user (ARPU) across all paying customers in a given month.

For example, if your average revenue per customer is $500 and you have 20 subscribing customers this month, then the MRR is $10,000 (500*20).

When calculating MRR, you’ll want to include all recurring elements, account upgrades, downgrades, and lost MRR from churned customers. You don’t need to include recurring costs but don’t forget to subtract discounts, as doing so will completely ruin your final tally.

MRR calculation: How to calculate MRR in 4 steps?

Calculating MRR isn’t as complicated. You can calculate it manually or use a specific subscription analytics tool. If you are calculating it manually, follow these steps.

1. Align revenue data

Create a spreadsheet with customer IDs and their corresponding monthly subscription value. For multi-month subscriptions, divide the total contract value by the number of months.

2. Sum up MRR

Add up the monthly subscription values for all your customers in that month. This total represents your overall MRR.

3. Break down by cohort

Top-level information is relevant and great, but it’s better to get tedious. This means breaking things down by type of pricing plans, cohorts, etc. Follow the same process detailed in the first two steps for each segment to analyze their individual MRR.

4. Calculate growth in MRR

Understanding your MRR growth is crucial to understanding your subscription base’s health. This growth MRR rate is the net increase or decrease in MRR from one month to the next month.

To calculate MRR growth, categorize your MRR into cohorts such as new MRR (from new customers), add-on MRR (from upgrades or add-ons), and churn MRR (lost revenue from cancellations).

To get your total growth MRR, follow this equation:

By following these steps, you can accurately measure your MRR, providing valuable insights into your business’s recurring revenue performance and helping you make informed strategic decisions.

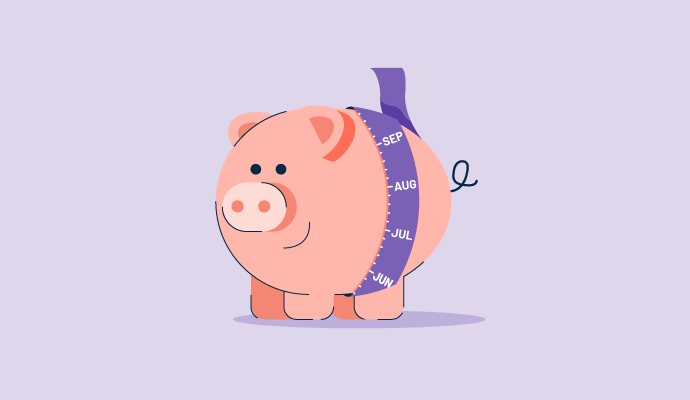

A real-life MRR example

Let’s say your company rolls into 2024 with an average of $20,000 MRR in 2023. You sign three new customers, each with six-month contracts in January of 2024 for $1,500 each. Your MRR from January to June is $24,500. At the end of June, only two out of three customers re-sign, so you have to subtract $1,500 from $24,500. Your MRR for July to August is now $23,000.

Let’s go even further. At the end of August, two customers add a $300 per month add-on, boosting your MRR by $600. Your MRR from September to December is $23,600.

Types of MRR

MRR can be broken down into several categories to provide a more nuanced view of your subscription business’s health. Here are the key dropdown#toggle” data-dropdown-placement-param=”top” data-term-id=”307706249″>new customers signing up for your service in a key performance indicator (KPI) that combines the positive aspects of MRR growth and subtracts the negative impact of churn. It provides a clear picture of your overall subscriber base health and growth trajectory. Here, the growth MRR will be $50/month. This shows some growth, but there’s room to improve customer retention and reduce downgrades.

By understanding these different types of MRR, you gain valuable insights into various aspects of your subscription business.

Why track MRR: 6 benefits

Tracking and understanding your MRR will help you plan accordingly and repair the areas that are failing. You will identify areas for improvement in customer acquisition, retention, upselling, and win-back strategies, ultimately leading to sustainable revenue growth and user retention.

The reasons SaaS companies and product-based companies utilize MRR are significant. Below are some of the top uses of the MRR metric.

1. Predictability and financial stability

MRR provides a clear picture of your recurring revenue stream. This predictability allows you to forecast future income, plan expenses effectively, and make informed financial decisions with confidence.

2. Focus on customer lifetime value (CLV or CLTV)

By understanding your MRR and average customer lifespan, you can calculate your CLTV, which is the total revenue a customer generates over their entire relationship with your business. This helps you prioritize strategies that maximize customer retention and value extraction.

3. Measure growth and identify trends

Tracking MRR over time allows you to monitor your business’s growth trajectory. You can identify trends in customer acquisition, retention, and churn, allowing you to pinpoint areas for improvement and optimize your marketing, sales, and customer success efforts.

Let’s say you’re a B2C company, and you get a ton of subscription purchases around November and December, but they drop off around May. How can you find out what caused that drop five to six months later? Well, if you’re tracking and analyzing certain patterns through your MRR, it can help you understand the cause, and you can work on preventing it in the future.

4. Evaluate sales and marketing strategies

MRR allows you to measure the effectiveness of your customer acquisition efforts. By comparing new customer acquisition costs to the revenue they generate, you can assess the return on investment (ROI) of your sales and marketing campaigns.

5. Benchmarking and competitive analysis

While keeping your own data confidential, industry benchmarks for MRR growth and churn can be valuable tools. You can compare your performance with competitors and identify areas where you might lag or excel.

6. Secure investment and funding

For subscription businesses seeking investment, a strong and predictable MRR is a key metric for potential investors. Tracking and demonstrating healthy MRR growth can significantly improve your chances of securing funding.

So, tracking MRR is not just about keeping an eye on monthly revenue; It informs a lot about business health and the trajectory it should take in the future.

What is a good MRR?

A good MRR depends on factors like growth rate, industry benchmarks, customer acquisition cost (CAC), customer lifetime value, churn rate, and business stage. Generally, early-stage startups aim for rapid MRR growth, while established businesses focus on maximizing MRR and minimizing churn.

Industry standards vary, but a healthy MRR should demonstrate consistent growth, a strong market position, and contribute towards profitability by covering operating expenses and achieving a favorable LTV/CAC ratio.

MRR vs. ARR

Another component in measuring revenue is annual recurring revenue (ARR). It’s the equivalent of MRR, but from a yearly perspective.

- MRR reflects your monthly income from subscriptions, giving a quick view of your cash flow and operational health.

- ARR takes a broader view, annualizing your MRR to show your predicted total subscription revenue for a year.

Both ARR and MRR are important SaaS metrics and allow you to plan for the short and long term. Using these metrics, you can obtain an elevated overview of your business and improve sales forecasting for the future.

Ready to track MRR?

MRR is an effective metric. If you’re not calculating it, you may be missing crucial information relevant to the success of your subscription business. If you are calculating MRR, take the next step: delve deeper into your MRR components and analyze churn, expansion MRR, and customer lifetime value.

Remember, a healthy MRR fosters predictable revenue, fuels growth, and ultimately paves the way for success in the subscription economy. So, embrace MRR and watch your subscription business flourish!

Are your subscription models perfect? Analyze them with subscription analytics tools and see better growth now.

This article was originally published in 2019. It has been updated with new information.