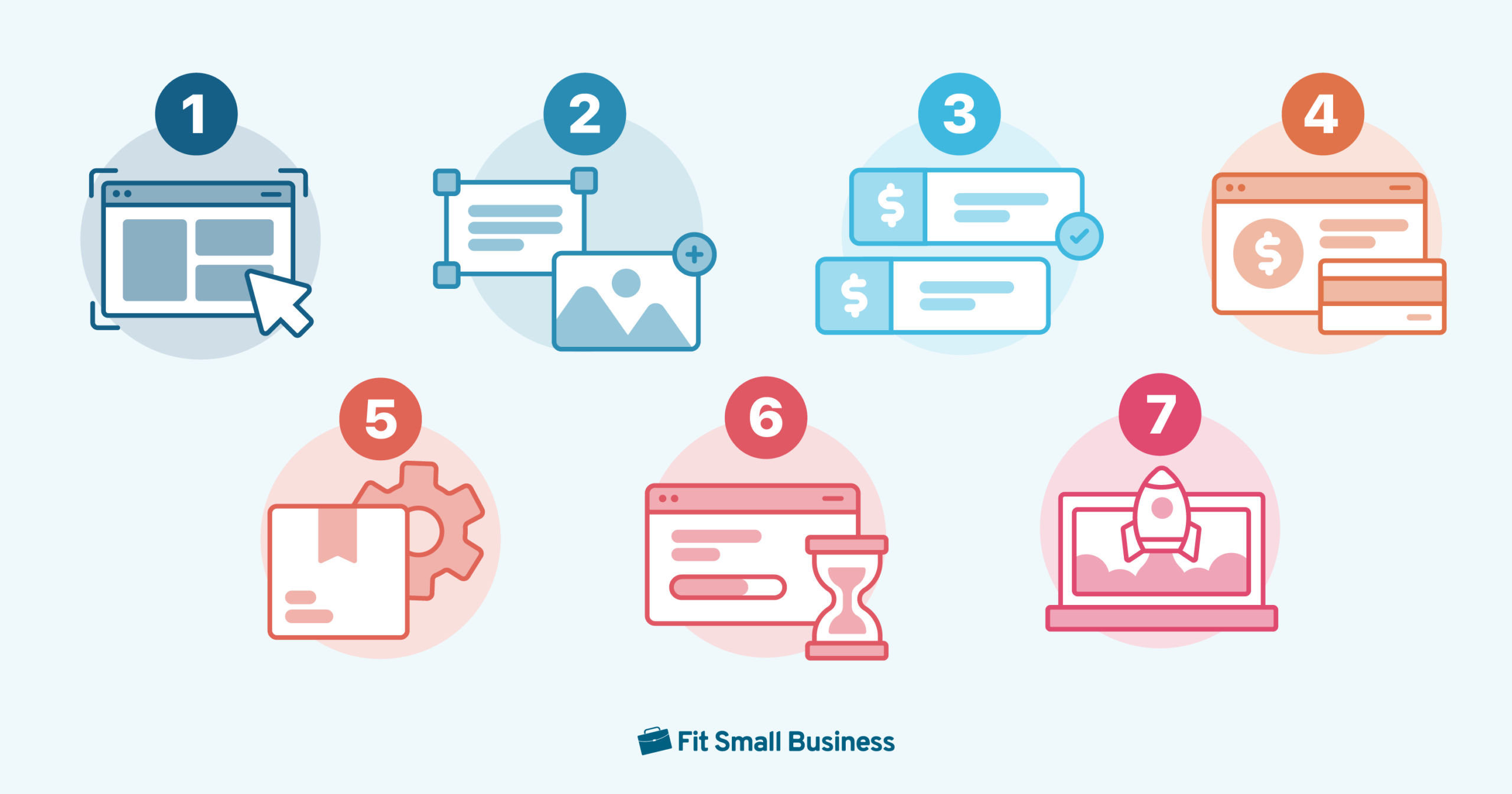

Semi-truck financing has different requirements and considerations from other small business loans. In this article, we will walk you through how to get semi-truck financing so that you can prepare accordingly and streamline the application process. We’ll go over everything from determining your needs and considering insurance coverage to choosing a lender and preparing documentation for your application.

Key Takeaways

- Semi-truck financing is a long-term financing option for businesses that are purchasing a truck for business purposes.

- Various types of lenders can extend financing options.

- Criteria for approval include your credit score, the type of truck you’re looking to finance, and your business history.

Step 1: Determine the Type of Semi-truck You Need

You’ll want to consider a variety of factors when determining the semi-truck you’ll need for your business, as a lender’s qualification requirements can vary depending on the type of vehicle you choose. It can also affect your company’s cash flow, so you’ll want to have a good idea of how the acquisition of a semi-truck will change your expense and revenue projections.

Here are some vehicle characteristics you’ll want to consider:

- Condition: New and used vehicles can provide for your business needs; whichever you choose may depend on your budget and preferences.

- New vehicles are generally more expensive but can offer a longer lifespan, better warranty, and customization options.

- Used vehicles are more budget-friendly but often have shorter warranties and lifespans and may require repairs or maintenance.

- Value: Depending on the vehicle’s value, financing options will be offered by the lender based on the total cost of the vehicle purchase. This can also affect the required down payment amount and your monthly loan payments.

- Mileage/odometer reading: You may be subject to mileage requirements implemented by the lender if you’re trying to finance a used vehicle. If the vehicle has high mileage, you may be considered ineligible.

- Age of vehicle: Qualification criteria may include requirements on the age of the vehicle along with an odometer reading. If you’re considering a used vehicle, this may be an important factor in the approval decision and will vary depending on the lender.

- Repair and maintenance history: Vehicles with a history of being regularly maintained can be less likely to require expensive repairs after you acquire them. You should consider how this may affect your business operations, as vehicles that are out of service for repairs can negatively impact your company’s cash flow.

- Type of seller: There are various types of sellers you can purchase a vehicle from, whether it be a dealer or private party seller.

To streamline the process later on, you should gather the make, model, and serial number of the vehicle you’re interested in. Your lender will utilize this information as part of the application, and doing your due diligence upfront can save a lot of time for both parties.

Step 2: Consider Insurance Coverage

Getting the right amount and type of semi-truck insurance is crucial to ensure coverage for both yourself and your lender. This is a general requirement of all lenders to obtain financing, but it’s also important for your business in mitigating financial risk. You’ll need to factor in state minimum coverage requirements as well, including coverage for the vehicle, cargo, and accessories like trailers or other attachments.

Here are some common types of coverage and what they are designed to protect against:

- Primary liability coverage: This is designed to cover damage done by your vehicle to people or property while driving on the road.

- Physical damage coverage: Offers protection against physical damage to your vehicle. This commonly covers damage as a result of theft or an accident.

- Bobtail coverage: Bobtail coverage protects against damages to other people or property when you have no trailer attached to your vehicle. This typically applies when you are still under dispatch and are in between dropping off and picking up another trailer.

- Nontrucking liability coverage: Although similar to bobtail coverage, non-trucking liability coverage offers protection when you are not under dispatch, utilizing the vehicle for personal uses.

- Cargo coverage: This can cover damage to your cargo which can occur as a result of a natural disaster, accident, or theft.

Step 3: Review Your Qualifications

Lenders will have varying qualification criteria for your business and the vehicle you’re looking to finance—taken into consideration will be your credit score, business history, and vehicle characteristics. Ensuring you meet basic requirements will set you up for success and help you prepare your loan application.

Here are some general guidelines to help you determine if you qualify:

- Credit score: Lenders will have varied credit score requirements; however, a score of 600 and above is generally acceptable and allows you to qualify for various financing opportunities.

- Business revenue: There may be annual revenue requirements implemented by some lenders—but this is not always the case. Some may factor in your total amount of debts instead of revenue to gain insight into whether you’ll be able to make loan payments. However, it is a benefit if you can provide such revenue figures, as doing so may increase your chances of getting approved and more favorable rates and terms.

- Time in business: Time in business requirements are determined by the lender but are not always necessary. Generally, six months or more of operations will lean in your favor for approval and can increase the chances of businesses with limited resources or credit history to gain financing.

- Down payment: Down payments are often required to finance a semi-truck, and the required amount will be based on the vehicle’s value. While some lenders may not require it, it can help you to secure a lower interest rate. Generally, plan to put down anywhere from 10% to 30%.

- Age of truck and mileage: Whether you’re purchasing a new or used vehicle, the lender may place requirements on the age and mileage of the vehicle. This is because the vehicle will likely serve as collateral to secure the loan. If the lender were to take possession of the vehicle, its value would need to cover loss in the event of default. This may make it more difficult if you’re looking to finance a used vehicle with high mileage with limited value.

- Time with a commercial driver’s license (CDL): In addition to time in business, lenders may consider the length of time you’ve had a CDL in evaluating your loan eligibility.

Step 4: Choose a Loan Type and Lender

There are different types of loans you can use to facilitate the purchase of a semi-truck. Some apply strictly to the acquisition of the asset, whereas others may be flexible and can be used for other business expenses. Loan rates and terms will vary depending on the loan type and lender you choose and are structured accordingly.

Types of Loans

Term loans are generally long-term financing options used for specific business purposes. It provides a lump sum of the requested funds, which can be used for a variety of needs to support your business, such as acquisition, expansion, and general purpose. The loan is structured typically with a monthly repayment schedule and offers a fixed or variable interest rate.

Equipment financing has a variety of options, usually via a loan or a lease. For the acquisition of equipment for your business, you can lease it for a short period and use it as needed. This is generally a cost-effective option for borrowers with limited resources. If you were to purchase the equipment and finance it via a loan, you’d be able to own the equipment and continue using it once the loan is paid off.

A small business line of credit acts as a revolving credit facility in which the borrower can request a draw on the line and receive funds on an as-needed basis. This is best for short-term expenses that can be repaid within the draw period, which is usually anywhere from 12 to 36 months.

If you’re looking for a highly-rated provider, we recommend Smarter Finance USA, which tops our list of the best equipment financing companies. It offers equipment financing and small business loans for several industries, has a network of over 37 lenders, and has flexible qualification requirements.

Types of Lenders

Regional and nationwide banks can have a wide variety of loan offerings. They also tend to have many branches you can visit if you prefer to meet in person. Keep in mind that qualification requirements are typically more rigorous at traditional lending institutions. You may want to view our list of the best banks for small businesses for options.

Credit unions are not-for-profit organizations that often offer competitive loan rates and terms. While they may not have as many loan offerings as traditional banks, they are a viable option for small businesses looking to bank locally. Criteria are commonly based on the location of your primary residence or place of employment. For our recommendations, check out the leading credit unions for small businesses.

There are numerous online lenders who can facilitate a wide variety of small business loans. They often offer competitive rates and terms since savings from not having a physical location can benefit the borrower in the form of lower rates and fees.

he best loan brokers have a large network of lenders it can use to shop your loan. This can save you time from having to apply separately to multiple lenders. By doing so, you’ll also improve your chances of getting approved at a competitive rate. See our top-recommended business loan brokers for options.

How to Choose a Lender

When choosing a lender, you’ll want to ensure you work with one that provides for your business needs and is suitable for your budget. Here are some criteria you should take into consideration when shopping around for a lender.

- Customer reviews and ratings

- Interest rates and fees

- Types of loans offered

- Type of lender (broker, bank, credit union, or online lender)

- Hours of operation and customer service availability

- Lender experience with your industry

- Funding speed

- Loan terms and monthly payments required

- Qualification requirements

- Required documentation (business financials, licenses, etc.)

If you need a resource to connect you with a variety of lenders, consider our partner Lendio. It has a wide variety of business lending options, from small business loans to equipment financing. With one simple application, you can provide your funding request details and be connected with multiple lenders who offer various loan options you may be eligible for.

Step 5: Apply and Submit Required Documents

When you’ve decided on the lender and loan type applicable to your financing needs, you can begin the application process. Oftentimes, there will be various documentation requirements supplemental to your application to help verify your eligibility. Requested documents will vary depending on the lender, but it’s best to keep certain documents on hand to help streamline the approval and disbursement process.

Here are some common items that most lenders will ask for:

- Personal tax returns (past 2 years)

- Business tax returns (past 2 years)

- Profit and loss statement (year-to-date)

- Business balance sheet

- Business bank statements (3 to 12 months)

- Copy of your CDL

- United States Department of Transportation (DOT) number

- Motor carrier number

- Insurance quote for vehicle you are purchasing

- Vehicle inspection, condition report, or other documentation about vehicle characteristics (make, model, serial number, odometer reading, or photos)

For additional information, reference our guide on how to get a small business loan for application tips for various business loans.

What to Expect After Applying

There are a few possible outcomes you can expect after applying. Here are some scenarios regarding your approval decision presented by a lender.

This is the best-case scenario and means that your loan is approved on the terms you have requested. You’ll be given additional disclosures which you can sign to formally accept the loan and receive your disbursement proceeds.

This usually means the lender needs some additional information. Typically, this just means the lender needs minor items on the verification of your business. It’s usually a good sign, and once you have provided additional information and met the requested conditions, you’ll be eligible for approval.

Counter-offers may occur if the lender can issue you some form of financing but not at the terms that you initially requested. In some cases, you can have discussions with the lender and provide additional documentation for it to reconsider alternative loan terms.

When critical information is missing, a lender will be unable to determine whether an approval or denial can be issued. Instead, it will request clarification from you to determine the next steps or additional information that may then be needed. There is still hope for approval, so be sure to provide all outstanding items requested.

If you are ineligible for a loan, a lender will issue a loan denial. It will discuss its reasoning with you so that you are aware of what disqualified your business and what you may be able to do to become eligible.

Alternatives to Semi-truck Financing

There are a few alternatives applicable to acquiring a semi-truck for your business.

- Small Business Administration (SBA) loans: SBA loans are another form of small business loans offered to small businesses needing financing from participating lenders. These loans are partly guaranteed by the government and offered to businesses with a strong credit history. This is a good option for business owners who will eventually be looking to own the acquired semi-truck or need a long-term financing structure to better suit their budget. For guidance, see our article on how to get an SBA loan.

- Operating leases: An operating lease is similar to finance leases; however, upon lease expiration, no ownership rights are transferred to the lessee. This is a viable option for businesses looking to use a semi-truck for a limited time, in which they can use and return the asset without ownership or maintenance responsibilities.

- Business credit cards: If you don’t want to take out a traditional loan but still pay off a semi-truck purchase over time, you can finance all or part of the expense with a business credit card. This may be an option for businesses planning on paying for part of the purchase from their own pockets and needing supplemental financing. For our recommendations, see our list of the best small business credit cards.

Frequently Asked Questions (FAQs)

Qualification requirements will vary by lender, but a credit score of 600 and above is generally a good rule of thumb to be eligible for approval.

Yes, and down payment requirements will vary depending on the lender and value of the semi-truck; however, anywhere from 10% to 30% is standard.

Depending on your business needs and goals, both leasing and financing are good options. If you eventually want to own the semi-truck and utilize it without restrictions, financing is likely your best bet. If you only need the semi-truck for a short-term project, leasing might be the better, as well as more cost-effective, option.

Bottom Line

Now that you know how to get a loan for a semi-truck, you can prepare accordingly and begin the application process. Obtaining semi-truck financing has various requirements in comparison to other types of small business loans, as you’ll need to consider factors such as vehicle type, insurance, and your business plans. As long as you do your research and find loans that are suitable for your budget and needs, you should be able to finance a semi-truck for your business successfully.

![how-to-create-a-pto-policy:-small-business-guide-[+-template]](https://zabollah.com/wp-content/uploads/2024/05/16725-how-to-create-a-pto-policy-small-business-guide-template.jpg)