Circle Becomes the First Global Stablecoin to Achieve MiCA Compliance

Circle, the issuer behind USDC and EURC, has secured compliance with the European Union’s Markets in Crypto-Assets (MiCA) regulatory framework. This achievement positions Circle as the first global stablecoin issuer to meet the rigorous standards set forth under MiCA.

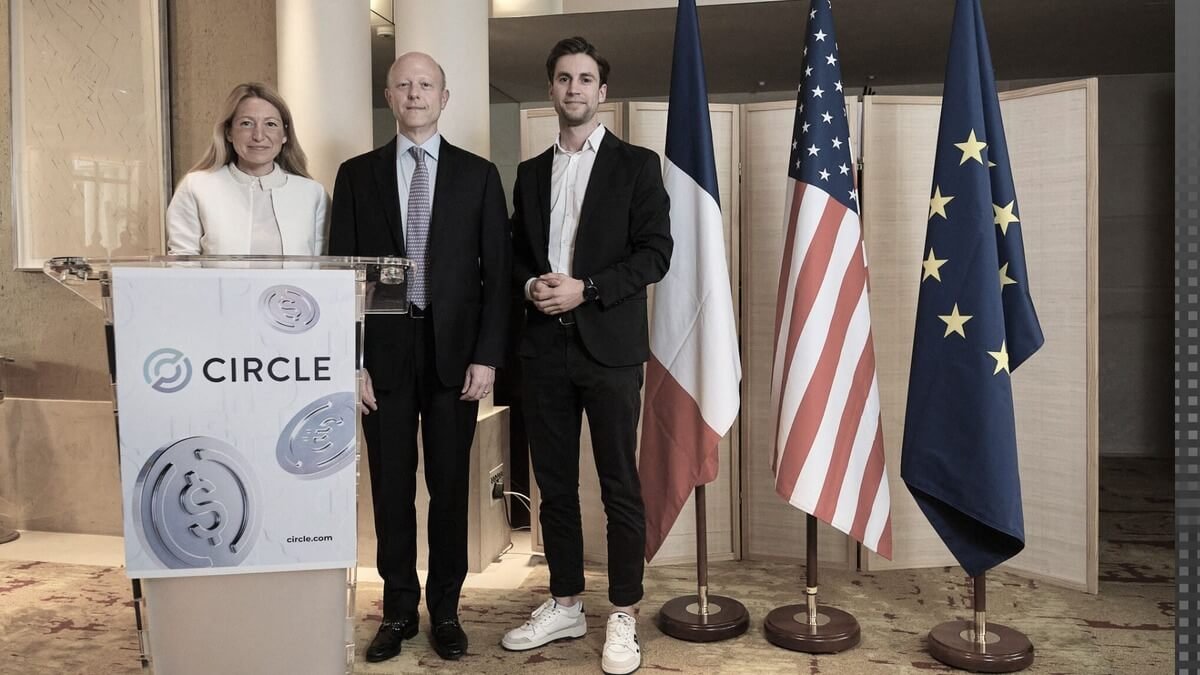

The milestone was made possible through Circle’s attainment of an Electronic Money Institution (EMI) license from the Autorité de Contrôle Prudentiel et de Résolution (ACPR), the French banking regulatory authority. This license empowers Circle to issue both USDC and EURC in the EU while meeting MiCA’s stringent regulatory obligations for stablecoins and e-money tokens.

Jeremy Allaire, Co-Founder and CEO of Circle, said: “Since our founding, Circle has prioritized building robust and compliant infrastructure for stablecoins. Achieving MiCA compliance is a pivotal moment in advancing digital currency into broader acceptance and mainstream finance.”

The newly established Circle Mint, based in France, now offers seamless access for business customers across Europe to mint and redeem USDC and EURC. This local presence, coupled with Circle’s comprehensive regulatory framework, ensures near-instant and cost-effective transactions, fostering a conducive environment for digital asset adoption.

Dante Disparte, Chief Strategy Officer and Head of Global Policy at Circle, emphasized the broader implications of MiCA compliance, stating, “As digital assets integrate deeper into global finance, establishing transparent and secure frameworks is essential. Today’s announcement reaffirms our commitment to fostering a compliant future for internet finance.”

Circle’s proactive approach to regulatory compliance contrasts sharply with its peers, as only USDC among the top 10 stablecoins by market capitalization currently meets MiCA standards. This distinction positions Circle at the forefront of driving mainstream adoption of regulated digital currencies, bolstered by its adherence to high standards of security, transparency, and regulatory oversight.

Coralie Billmann, Managing Director of Circle France, acknowledged the collaborative efforts that culminated in this achievement, noting, “Obtaining this license reflects months of cooperation between ACPR regulatory teams and Circle France. It marks a pivotal moment not only for Circle but for the broader digital financial ecosystem.”

The current stablecoin market is showing signs of stabilization and recovery. As of the latest data from CoinMarketCap, the total market capitalization of stablecoins has reached approximately $163 billion. This reflects a significant increase compared to previous years and highlights the growing importance of stablecoins in the digital currency landscape.

In terms of individual stablecoins, Tether (USDT) remains the dominant player with a market capitalization of around $112 billion. Other major stablecoins like USD Coin (USDC) and DAI have also seen their market caps grow, with USDC at $33.6 billion and DAI at $5.3 billion.

The stablecoin market has been impacted by various factors, including regulatory developments, market volatility, and changes in investor sentiment. However, despite these challenges, stablecoins have continued to gain traction as a reliable and convenient means of transferring value in the digital economy.

With MiCA compliance now secured, Circle seems to lead the charge in integrating regulated digital currencies into global financial systems.