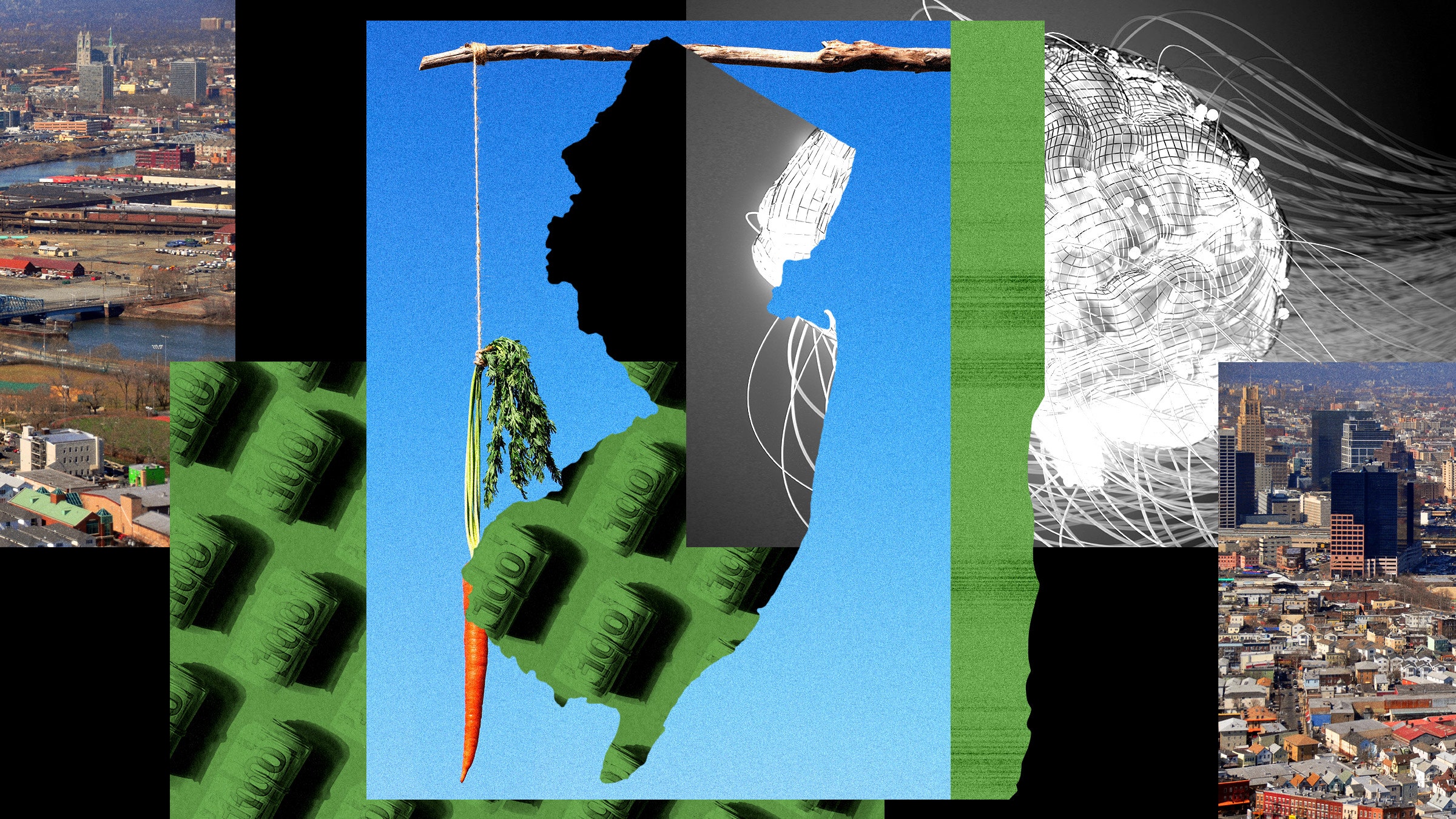

New Jersey’s $500 Million Bid to Become an AI Epicenter

New Jersey has a new plan to become the US hub for AI innovation. The state’s governor signed a law on Thursday that will offer up to $500 million in tax credits for artificial intelligence companies to set up shop in the state.

“We want New Jerseyans to stand at the forefront of the AI revolution—and build a more prosperous world in the process,” New Jersey governor Phil Murphy, a Democrat, said in a statement. “And in so doing, we are going to establish New Jersey as the home base for R&D in generative AI.”

AI companies and data centers that power AI and operate at large scales in New Jersey can qualify for the tax credits, which divert unspent funds from two other state tax credit programs for job creation and real estate development enacted in response to the Covid-19 pandemic.

Critics of the plan fear that it could be a win for profitable AI companies but a loss for the state. Data centers typically require few employees, and tax incentives generally—including those thrown at tech companies—can prove costlier than what they return. In an analysis of the bill, New Jersey’s Office of Legislative Services, an agency in the state legislature that provides nonpartisan support, notes that it “cannot determine whether the bill will have a positive or negative net fiscal impact” on the state.

The tax credits follow Murphy’s “AI Moonshot” vision for New Jersey, announced early this year. Murphy has said he intended for the state’s actions to “establish New Jersey as the home base for AI-powered game changers.”

New Jersey’s own homegrown CoreWeave, a cloud provider for AI, recently raised $1.1 billion and is valued at $19 billion. And the state could multiply its market by capitalizing on the growing demand for data centers in the New York area: Vacancies for leased locations dropped from 9.7 percent to 6.5 percent from the beginning of 2023 to the second half of the year, according to a report from commercial real estate firm CBRE. The report also noted that an AI company has pre-leased space in East Windsor, a New Jersey town between New York and Philadelphia.

And AI businesses are driving a surge in venture capital funding. These highly profitable companies need data centers to do business. They will put them somewhere, and they won’t need incentives to do it. “This is a growing, very healthy industry that doesn’t need any public support to do its business,” says Kasia Tarczynska, senior research analyst at Good Jobs First, a US national policy resource center that promotes corporate and government accountability in economic development.

Data centers and companies working in AI are often eligible for general business tax incentives in the US. But those data center tax credits are “not particularly strategic,” says Tim Sullivan, CEO of the New Jersey Economic Development Authority.

New Jersey’s plan is different from other states, he contends, because companies that benefit from the tax credit will have to reserve some computing power at discounted rates or provide AI support for smaller companies or universities. And while property in New Jersey isn’t cheap (it has the highest corporate tax rate in the US), proximity to large populations is highly valuable to data centers. Opening the sites closer to businesses helps to lower latency.

New Jersey itself is a home to many large pharmaceutical companies—and if these companies use AI to design new drugs, nearby data centers are vital, Sullivan says.

“If you’re three people at a desk trying to develop the next Google, the next Tesla—in the AI space or in any space—this computing power is scarce. And it’s very valuable. It’s essential,” Sullivan says. So, in addition to any permanent jobs created by these companies, the tax incentives could lead to further growth and innovation for smaller startups, he claims. “The potential for economic impact is off the charts.”

Still, skeptical policy experts say the AI carveout may just be a new bow on an older idea, coming as the AI boom creates a rapid increase in demand for data centers. “There’s just this history of [tax incentive] deals building up the necessary infrastructure for these tech firms and not paying off for the taxpayer,” says Pat Garofalo, director of state and local policy at the American Economic Liberties Project, a nonprofit organization that calls for government accountability. The loss in tax revenue “is often astronomical” when compared to each job created, Garofalo says.

A 2016 report by Tarczynska showed that governments often forego more than $1 million in taxes for each job created when subsidizing data centers that are built by large companies, and many data centers create between 100 and 200 permanent jobs. The local impact may be small, but The Data Center Coalition, an industry group, paints a different picture: Each job at a data center supports more than six jobs elsewhere, a 2023 study it commissioned found.

In other states, a backlash against data centers is growing. Northern Virginia, home to a high concentration of data centers that sit close to Washington, DC, has seen political shifts as people oppose the centers’ growing presence. In May, Georgia’s governor vetoed a bill that would have halted tax breaks for two years as the state studied the energy impact of the centers, which are rapidly expanding near Atlanta.

This hasn’t deterred Big Tech companies’ expansion: In May, Microsoft announced it would build a new AI data center in Wisconsin, making a $3.3 billion investment and partnering with a local technical college to train and certify more than 1,000 students over the next five years to work in the new data center or IT jobs in the region. Google said just a month earlier it would build a $2 billion AI data center in Indiana, which is expected to create 200 jobs. Google will get a 35-year sales tax exemption in return if it makes an $800 million capital investment.

In Europe, the same contradictory approach is playing out: Some cities, including Amsterdam and Frankfurt, where companies have already set up data centers, are pushing new restrictions. In Ireland, data centers now account for one-fifth of the energy used in the country—more than all of the nation’s homes combined—raising concerns over their impact on the climate. Others are seeking out the economic opportunity: The Labour Party in the UK promised to make it easier to build data centers before emerging victorious in the recent UK election.

The New Jersey measure made its way through the state legislature quickly in June—it was introduced and voted on by lawmakers in just weeks as the state finalized its budget. To qualify, the business must have half of its employees “engaged in AI-related activities,” or half of its revenue generated from AI-related activities. The companies must also make a minimum $100 million capital investment and create at least 100 new full-time jobs.

The plan has gained support from the local business sector. “In the quickly evolving world of AI, and with New Jersey’s high tax [and] high-cost business climate, our state competitiveness matters,” says Christopher Emigholz, the chief government affairs officer of the New Jersey Business & Industry Association.

New Jersey’s goal for this seems to be to elevate its status, to be “on the cutting edge” of the AI industry, says Peter Chen, a senior policy analyst with New Jersey Policy Perspective, a think tank. “Does this really get us there? AI is so broadly defined,” he says. “AI could be anything.” And the burgeoning AI industry has hang-ups: Generative AI needs excessive amounts of energy and water to function, some companies that develop large generative language and image models face accusations of copyright infringement, and large companies have been accused of rushing to develop the tech without proper safeguards.

AI companies will ultimately build these centers—the tax incentives may just be added bonuses. Still, it’s something New Jersey hopes can entice big players closer. “We want to make sure that New Jersey is one on the leading edge of it,” Sullivan says. “Whatever happens, we want it to happen here.”